What Happens If You Die Without a Living Trust? These 3 Real Stories Speak Volumes

We don’t like to think about death.

But for your family, what happens after you’re gone can either be a smooth handoff, or a years-long legal nightmare. These aren’t hypotheticals.

These are true, documented stories that show why having a living trust isn’t just for the wealthy—it’s for anyone who loves someone.

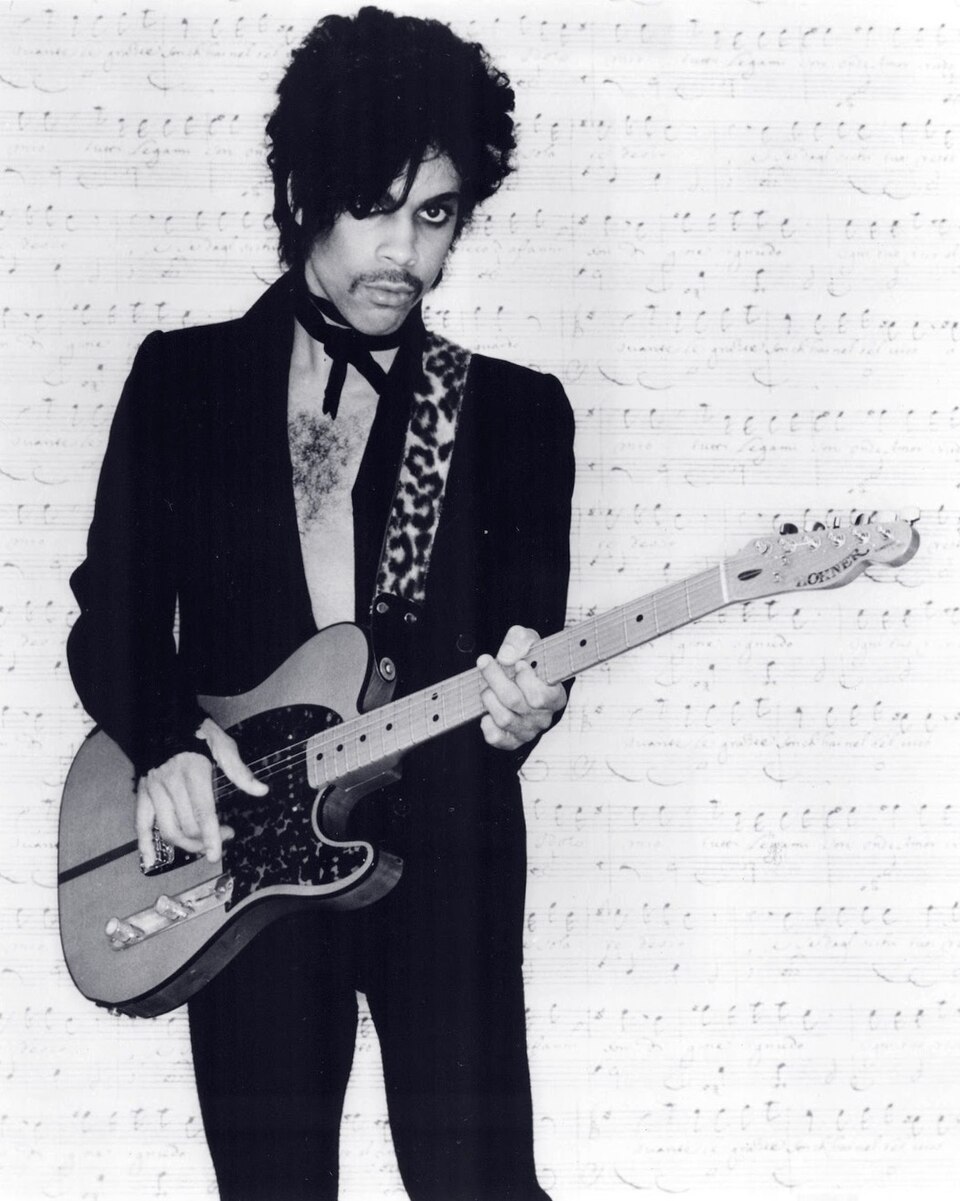

1. Prince (2016): A Music Legend, a Messy Aftermath

Image credit: Public domain (U.S.); Photo by Allen Beaulieu, via Wikimedia Commons

When Prince passed in 2016, the world lost a legend. His family lost more. He left behind a $156 million estate—but no will, no trust, no instructions.

What came next wasn’t grief. It was chaos.

The court was flooded with 45+ inheritance claims, some from total strangers

The siblings spent $3 million just fighting off people trying to claim a piece of the estate, and a $31 million tax bill from the IRS—before they even got their cut.

It was six years, over 2,700 court filings, DNA tests, and $45 million legal fees by 2019

Prince’s sister and five half-siblings were finally declared the rightful heirs—but not before the process drained time, money, and any chance at privacy.

His most private affairs, were dragged through public record

When you leave nothing in writing, the state steps in—and chaos follows. A living trust could’ve protected his family from six years of stress and preserved the privacy Prince valued so deeply. (Source: The Law Office of Antoinette Bone)

2. Aretha Franklin (2018): Three Wills, One Couch Cushion, and Five Years of Legal War

Image credit: Public domain (U.S.); Aretha Franklin, 1968 publicity photo by Atlantic Records. Originally published in Billboard Magazine, February 17, 1968 via Wikimedia Commons

Aretha Franklin passed away in 2018 without a formal estate plan. Months later, her family discovered two handwritten wills tucked away in her home, one written in 2010 and one in 2014. Each version laid out different instructions about who should get what.

Her children spent four years in probate court

The whole process put siblings at odds, creating deep tension at a time when they were supposed to be grieving

The documents conflicted over key assets

In 2023, a jury ruled that the will found under the couch cushion was valid.

Personal details—royalties, family dynamics, even disagreements—were aired in public

In a time of grief, confusion over handwritten documents nearly tore a family apart. A properly executed living trust would’ve allowed Aretha’s final wishes to be honored quietly—preserving both her legacy and her loved ones’ peace. (Source: Vanity Fair)

3. Anne Heche (2022): A Son in Court Instead of at Peace

Image credit: CC BY 2.0; Anne Heche, July 14, 2014 photo by Mingle Media TV. Originally published on Flickr, via Wikimedia Commons. Edited to black and white.

Anne Heche died in a tragic car crash in 2022, leaving behind two sons—but no will, no trust, and no plan. Her oldest son, just 20 at the time, had to take charge of the estate and guardianship of his younger brother, all while grieving. But Anne’s ex contested his petition, and the family was pulled into a public legal fight.

Homer, at just 20, had to take on guardianship, estate management, and court battles, all while grieving

The family was dragged into a public dispute over control of the estate and guardianship of the younger son

The estate faced over $6 million in debt, including lawsuits tied to the crash

Personal family matters—including financial hardship—were exposed in the press and legal filings

The court eventually sided with Homer—but not without months of legal stress and emotional weight

No one plans to die young—but without a trust, Anne’s sons were left to deal with court battles, debt, and guardianship decisions on their own. A living trust could’ve protected them and spared them the legal burden during a time of grief (Source: Downs Law Firm P.C.)

What These Stories Have in Common

These weren’t just paperwork problems. They were heartbreaks that got dragged out—publicly, painfully, and unnecessarily.

Three different families. Three different legacies. Same mistake: no living trust.

It’s not about being famous or wealthy. It’s about leaving your family with answers, not questions. About making things easier, not harder, in the middle of their hardest moments.

You can’t control when you go—but you can control what happens next.

Ready to Protect the People You Love?

If you’ve been putting this off, you’re not alone. But waiting doesn’t make it easier. It just makes it riskier.

Book your free consultation with Legacy Promises Network and let’s walk through your options—no pressure, no overwhelm, just clarity.

Do it for them. Do it while you can.

Start you journey with Legacy Promises Network today.